Reports from the Knowledge Labs about our recent findings, research topics, and interviews with lifestyle leaders who are creating their own futures.

|

|

| |

How to stimulate your own powers of foresight. Consider the following thought provokers. Ask yourself, in these categories what are the brand new trends and forces? Which are the ones growing in importance? Which current forces are loosing their steam? Which have peaked or are reversing themselves? Which are the "wildcards" about to disrupt us in the future? POLITICAL AND TECHNICAL thought for food: Electronics, Materials, Energy, Fossil, Nuclear, Alternative, Other, Manufacturing (techniques), Agriculture, Machinery and Equipment, Distribution, Transportation (Urban, Mass, Personal, Surface, Sea, Subsurface, Space), Communication (Printed, Spoken, Interactive, Media), Computers (Information, Knowledge, Storage & Retrieval, Design, Network Resources), Post-Cold War, Third World, Conflict (Local, Regional, Global), Arms Limitation, Undeclared Wars, Terrorism, Nuclear Proliferation, Weapons of Mass Destruction, Governments (More/Less Power and Larger or Smaller Scale), Taxes, Isms: Nationalism, Regionalism, Protectionism, Populism, Cartels, Multinational Corporations, Balance of Trade, Third Party Payments, Regulations (OSHA, etc.) Environmental Impact, U.S. Prestige Abroad. SOCIAL AND ECONOMIC Food for thought:

Labor Movements, Unemployment / Employment Cycles, Recession, Employment Patterns, Work Hours / Schedules, Fringe Benefits, Management Approaches, Accounting Policies, Productivity, Energy Costs, Balance of Payments, Inflation, Taxes, Rates of Real Growth, Distribution of Wealth, Capital Availability and Costs, Reliability of Forecasts, Raw Materials, Availability and Costs, Global versus National Economy, Market versus Planned Economies, Generations: Y, X, Boomers, Elderly, Urban vs. Rural Lifestyles, Affluent vs. Poor, Neighborhoods and Communities, Planned or Organic Growth.

Got Knowledge?

|

|

| |

|

|

|

|

The Journal of 2020 Foresight

|

|

| |

|

Saturday, August 02, 2003

Timeshare This: Correction, Boom, Bubble, Burst, Bust, Correction, Bear-Depression

Chapter Three

By Steve Howard, CKO

The Knowledge Labs

Table of Contents

Chapter One: Basecamp

Chapter Two: The Ridge

Chapter Three: The Outpost

Chapter Four: The Tribal Territories

“Every journey must begin somewhere. For this expedition, the greatest in American history, it began in the mind of Thomas Jefferson. America’s third president had wanted to send an exploring party into the West for many years. In 1783, he had proposed such a venture to Revolutionary War hero General George Rogers Clark, William’s older brother. The Hannibal of the West had declined. Two subsequent attempts to have the West explored and the existence of the Northwest Passage proved also died aborning.”

James J. Holmberg

Journal of 2020 Foresight: Have you ever felt embarrassed when out of the blue you bump into someone who looks really, really familiar, but you can’t place him?

Did we work together in the past?

Do we go to the same dentist?

Were we in the same graduating class?

And, usually for me that embarrassing moment happens in locations out of context. As, when I met Lone Eagle sitting at a bar table underneath the azure blue umbrella on the patio, steps away from the lower pool. Somebody in the Jacuzzi waved to me and I had no idea who he was.

Eagle: Surprise, didn’t you see Lost Explorer?

J2020F: Oh my gawd. That’s who it was. He looks so different in a bathing suit. Or is it this setting, overlooking Medano Beach and the Sea of Cortez? And, I hadn’t had my first 2-for-1 special. But, here they were, the neo - Lewis and Clark and me, their chronicler, in the middle of the resort action in Cabo San Lucas, Mexico.

Eagle: The last time we all got together you interviewed the two of us with Pathfinder and Trailblazer.

J2020F: How well I remember. What Pathfinder described at the end of the evening when the beach bonfire burned itself down to glowing red and orange embers kept me awake until 3 a.m.

Explorer: (Joining us at the patio table) Oh, the second of Dent ‘s two predictions?

J2020F: That period of prosperity is followed by the “mother-of-all-depressions” as he describes it.

Eagle: Starting sometime in 2010 and lasting until 2025, as I recall.

Explorer: Well, that certainly got my attention the first time, too. And, now I feel more of an urgency to make the most of the next 5 or 6 years and then figure out how to hang on for a decade.

J2020F: Nice transition. With both of you here, I’d like to learn more about the Outpost. Trailblazer described the 8 scenarios and ended my stay on the Ridge telling me what the HR executives found when they completed rehearsing their decision. How did your original scenarios turn out? Have you updated them at all?

Eagle: In the Outpost, as you already know, we pick relevant signposts and indicators to monitor as we move forward to our destination. We both discovered that the terrain ahead isn’t smooth like on paper or in plans and in models.

Explorer: It’s more three-dimensional. Over the next two decades from 2003 to 2020, just in terms of an economic climate, we anticipate a correction, boom, bubble, burst, bust, correction, and that long bear / depression.

J2020F: So, like another roller coaster ride. Taking us uphill, then screaming downward again for quite a ride, until 2020?

Explorer: That’s right. We’ve been monitoring Harry Dent’s forecasts with his analysis of three recent bubbles for clues – Japan, Internet, and the Nasdaq.

J2020F: What have you concluded from the first?

Eagle: As a leading indicator, Dent says Japan’s major demographic peaked in terms of a spending wave two decades ahead of our boomers – roughly in 1989 after dominating the marketplace when it emerged in the late 1960s.

J2020F: As a leading indicator?

Eagle: As a scenario for our economy. I mean, when their consumers aged and cut back on spending, Dent says the Japanese government focused on key manufacturing technologies while propping up their real estate market through low cost corporate debt.

Explorer: Those policies set in motion two bubbles – stock and real estate – both of which burst and triggered their long bear market that may bottom out in 2004, according to Dent.

J2020F: Is there another Japanese spending wave any time soon on the horizon?

Explorer: As it turns out, their economy may behave as the mirror opposite of ours. Dent forecasts their next spending wave to exert itself in 2008 or 2009 and extend into 2020.

Eagle: I’m sure you picked up snatches of conversation around the pool here about our upcoming real estate bubble.

J2020F: Uh huh, some of the conversations seem to be about wondering if real estate will suffer the fate of the other two bubbles.

Eagle: When the Internet hit the 10% break out turning point – in the number of U.S. households early in 1996 – it only took two years to accelerate into a bubble from 1998 to 2000.

Explorer: The Internet stock index grew 7 times in 18 months alone, before crashing 92% from its highs.

J2020F: What’s Dent’s prognosis?

Explorer: In 2001, the Internet penetrated 50% of homes and will likely reach early maturity – in 9 out of 10 homes – in 2007.

Eagle: But, he doesn’t expect the index to recover everything wiped out.

J2020F: Why not?

Eagle: Basically, it’s the nature of the Internet. It allows computers, mobile devices, and content to be leveraged, but it’s not a highly profitable product or infrastructure in itself.

J2020F: So it enables other industries to become more efficient, but doesn’t hold up as a viable business model?

Explorer: When you peal away the layers, you see that semiconductor chips and software are the driving technologies.

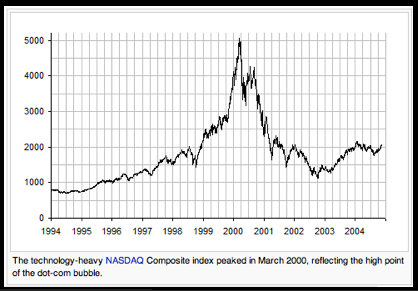

J2020F: Now, what about the third bubble, the Nasdaq?

Eagle: It actually began before the Internet index, sometime in 1995, but accelerated in parallel – from 1998 to 2000.

Explorer: As it turns out, it didn’t wipe out as much of the previous gains as did the Internet, nor did it last for two decades like the Japanese bubble.

J2020F: Knowing what you know now, how do you apply it?

Explorer: We’ll go into more detail later, but based on Dent’s work, we’re focusing on 5 time periods to shift our stock market and real estate investments: 2004 to 2006, 2006 to 2008, 2009 to 2010, 2015 to 2020, and 2020 to 2023.

Eagle: The strategy for the first period actually began in the late 1990s. Dent recommends buying growth stocks – both small and large capitalizations – but more large, while heavily investing in international emerging countries.

J2020F: So, if I’ve got a 401K or an IRA and want to invest in mutual funds I’m looking to diversify into those funds?

Eagle: Right. Dent recommends 15% of your portfolio should be in the small caps, with 35% in large cap, another 10% in Real Estate Investment Trusts, around 20% in an international fund – emerging countries in Asia (but, not Japan yet), Latin America, Russia and eastern Europe – another 10% in developed countries, such as Europe, Hong Kong, Canada or Australia, and the last 10% in high-yield bond funds.

J2020F: What about during the next phase – late 2006 to late 2008?

Explorer: This period precedes the major correction, so he suggests moving out of stocks into long-term treasury or very high-quality corporate bonds.

Eagle: Then during the next period – 2009 to 2010 – or, as Dent says after the first serious U.S. and global stock correction, shift 20 to 40% of your bond portfolio into Japanese stocks, and some European.

J2020F: So, you start to buy Japanese stocks ahead of their run-up based on their next demographic spending cycle.

Eagle: That’s right . You’re not really trying to outguess the markets in the short-term. Rather, you’re looking for long-term buying opportunities.

J2020F: But, what about during the depression?

Explorer: Between 2015 and 2010, Dent recommends a strategy of buying global stocks of emerging countries and small cap stocks in the U.S. Plus, he says step back into real estate to take advantage of the exurban migration.

J2020F: And, what about his investment strategy during the fifth time frame?

Eagle: From 2020 to 2023, he forecasts another long-term bull market. So, he recommends a return to a classic portfolio – 30% in large caps, 20% in small caps, 10% in real estate, 30% international, and 10% in bonds.

J2020F: A moment ago we talked about the real estate gossip around the pool. And, you said Harry Dent predicts that investing in the Internet technologies might not be the best long-term strategy. So, what’s the connection between the two?

Explorer: Dent says new technologies provide us with new means of communication and with alternative energy sources, almost any geographic area can support both or personal and professional goals.

J2020F: So, he’s predicting support for the “It’s Wired (Wireless) – Doing What I Want Anywhere” scenario sooner than later?

Eagle: Correct. He cites the following four trends as the reason:

“Basic innovation in communication technologies is allowing more people to relocate their homes to small towns and exurbs, and telecommute to business;

The baby boomers are moving into their vacation-home-buying years, which, in combination with the first trend, will stimulate demand for property in attractive resort towns;

The echo baby-boom generation is now moving into its household formation years, which will stimulate demand for apartments and rental property in the cities, and has already caused commercial property in these areas to appreciate; and

There is a broad geographic migration towards areas of the country with warmer climates. You can expect the first three trends to be accentuated in the southwestern United States.”

J2020F: And, the bottom line, then becomes select the highest growth area -- south of the Mason-Dixon line, and to the west. Concentrate on a region based upon your climate, lifestyle and growth stage preferences.

Explorer: Remember that when Oscar picks us up tomorrow morning for our timeshare presentation.

Got Knowledge?

Copyright ©2002 - 2006 Aarnaes Howard Associates. All rights reserved worldwide.

4:43 PM

|

|

| |

|

|

|