Reports from the Knowledge Labs about our recent findings, research topics, and interviews with lifestyle leaders who are creating their own futures.

|

|

| |

How to stimulate your own powers of foresight. Consider the following thought provokers. Ask yourself, in these categories what are the brand new trends and forces? Which are the ones growing in importance? Which current forces are loosing their steam? Which have peaked or are reversing themselves? Which are the "wildcards" about to disrupt us in the future? POLITICAL AND TECHNICAL thought for food: Electronics, Materials, Energy, Fossil, Nuclear, Alternative, Other, Manufacturing (techniques), Agriculture, Machinery and Equipment, Distribution, Transportation (Urban, Mass, Personal, Surface, Sea, Subsurface, Space), Communication (Printed, Spoken, Interactive, Media), Computers (Information, Knowledge, Storage & Retrieval, Design, Network Resources), Post-Cold War, Third World, Conflict (Local, Regional, Global), Arms Limitation, Undeclared Wars, Terrorism, Nuclear Proliferation, Weapons of Mass Destruction, Governments (More/Less Power and Larger or Smaller Scale), Taxes, Isms: Nationalism, Regionalism, Protectionism, Populism, Cartels, Multinational Corporations, Balance of Trade, Third Party Payments, Regulations (OSHA, etc.) Environmental Impact, U.S. Prestige Abroad. SOCIAL AND ECONOMIC Food for thought:

Labor Movements, Unemployment / Employment Cycles, Recession, Employment Patterns, Work Hours / Schedules, Fringe Benefits, Management Approaches, Accounting Policies, Productivity, Energy Costs, Balance of Payments, Inflation, Taxes, Rates of Real Growth, Distribution of Wealth, Capital Availability and Costs, Reliability of Forecasts, Raw Materials, Availability and Costs, Global versus National Economy, Market versus Planned Economies, Generations: Y, X, Boomers, Elderly, Urban vs. Rural Lifestyles, Affluent vs. Poor, Neighborhoods and Communities, Planned or Organic Growth.

Got Knowledge?

|

|

| |

|

|

|

|

The Journal of 2020 Foresight

|

|

| |

|

Wednesday, June 18, 2003

Forming Breakpoint Alliances to Fill Competency Gaps

Chapter Two: The Ridge

By Steve Howard, CKO

The Knowledge Labs

Table of Contents

Chapter One: Basecamp

Chapter Two: The Ridge

Chapter Three: The Outpost

Chapter Four: The Tribal Territories

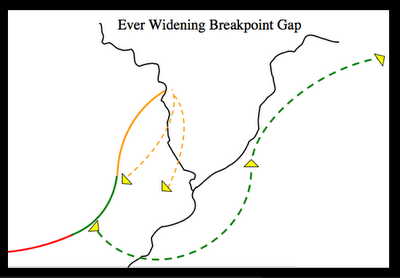

“(Why is it that) the acquisitions and task forces methods worked so much better than venture capital participation, strategic alliance, or restructuring into separate divisions...? The interplay between forces of change and resistance reflected in the choice of an intervention path dictates the approach to organizing for radical change. The change force creates the need for specific organizational capabilities to close the competence gap.”

Paul Stebel, Breakpoints

Journal of 2020 Foresight: Last time you said that frequently the resources and competence needed to journey to the other side of a breakpoint gap cannot be developed in-house, especially under time pressure.

Trailblazer: Pretty quickly a leader can recognize that the resource commitment may also be too large or risky for one company alone.

J2020F: Are these the external initiatives you described earlier as development opportunities for managers?

TB: Yes.

J2020F: How do you decide which of the four options to take?

TB: Well, at first it seems overly complex. But the best way is to complement the internal change processes – incremental or fundamental innovation and cost reduction or business process initiatives.

J2020F: So they line up along the four resistance, revitalization, renewal, and restructuring paths – just as the internal innovation and efficiency approaches?

TB: Yes. These correspond to a strong and weak change force represented by the strategic need for external organization and strong and weak resistance caused by lack of a cultural fit with potential outside partners.

J2020F: What do you mean?

TB: The strategic need for external organization depends on how much of the organizational capability gap can be closed in a cost-effective and timely manner with internal organization: the more provided internally, the less needed externally.

J2020F: Give me an example.

TB: Take the first option on the resistance path. How well will organizational spin-offs or increasing the scale of operations close the organizational capability gap? If the answer is not enough, then turn to arm’s-length relationships.

J2020F: How does that satisfy the resistance requirements?

TB: Licensing agreements, R&D-limited partnerships, and venture capital participation all provide the promise of bringing focused expertise into the business relatively quickly without altering the existing mainstream organization.

J2020F: But, isn’t the bottom line about transferring expertise?

TB: Yes. The focus and specificity of licensing and R&D partnerships have produced a better track record than venture capital in actually transferring expertise. These relationships can be particularly useful in providing quick access to incremental competence and resources.

J2020F: Isn’t this option one that GE is famous for?

TB: Yes. General Electric has regularly used arm's-length relationships to complement the expertise of internal task forces developing new business ventures." For example, after deciding to forward integrate into compressors, the Turbine Division hired the Stanford Research Institute to analyze the industry and competitors and explore ways of entering the business.

J2020F: The next option – integrated merger – brings more disruption to the existing mainstream organization, right?

TB: The successful integration of two existing organizations is possible only on the basis of a good strategic and cultural fit. Merging two organizations is a notoriously lengthy and difficult process that affects both profoundly, even when the cultural gap is small.

J2020F: So, they need an important long-term strategic payoff, like that provided by revitalization?

TB: Of course. Organizational mergers have to be used with care as an external complement to internal change. When the cultural fit is poor, organizational mergers have a very low rate of success.

J2020F: What complements the internal task forces for innovation or cost cutting on the renewal track?

TB: Supplier and customer alliances and networks, union partnerships, and government-supported projects provide an intensive basis for exchanging know-how and building new internal competence.

J2020F: I’d imagine in addition to know-how, specific resources can be traded or pooled to deal with a breakpoint, right?

TB: Right. But the development of a fruitful relationship takes time and presupposes that the cultural gap between the partners can be closed.

J2020F: If it can, then what?

TB: This opportunity for concentrating the interaction makes special partnerships useful on a renewal path; for example, as a way of out-sourcing and subcontracting parts of the business system.

J2020F: Along with the restructuring for team competition and for cutting costs on the breakpoint approach, you’ve mentioned hostile takeovers. I’d assume that the cultural gap is far from being closed, right?

TB: When the strategic fit is there but the cultural fit is not, common sense suggests an acquisition that avoids organizational integration.

J2020F: Then, why do it?

TB: In an organizationally separate takeover, the resources of the acquirer and acquiree may be shared. Because of the poor cultural fit no attempt is made to integrate the two organizations and share activities.

J2020F: But, how do the two organizations realize the full benefits, if they remain separate?

TB: You’re right. To get the full benefits of the synergy implied by a good strategic fit, some integration and sharing of activities are called for. This contradiction is one of the main reasons why such acquisitions have so high a failure rate: those that attempt integration flounder on the cultural gap; those that avoid integration forego important synergy.

J2020F: Is there any way that it can work?

TB: Well the typical scenario unfolds this way. The two senior layers of the target management are removed; managers from the acquirer take over the top of the acquired company; at the same time, third-level managers in the acquired company are promoted to the second level.

J2020F: No wonder it’s called hostile.

TB: Sure. Since the target management can usually sense what is going to happen, it will rarely recommend this kind of takeover to its board. As a result, the takeover becomes hostile both in financial and organizational terms.

J2020F: Isn't there another choice management can take, or a capability that can be developed that achieves the same objective but is less disruptive?

Got Knowledge?

Copyright ©2002 - 2006 Aarnaes Howard Associates. All rights reserved worldwide.

7:19 AM

|

|

| |

|

|

|