Reports from the Knowledge Labs about our recent findings, research topics, and interviews with lifestyle leaders who are creating their own futures.

|

|

| |

How to stimulate your own powers of foresight. Consider the following thought provokers. Ask yourself, in these categories what are the brand new trends and forces? Which are the ones growing in importance? Which current forces are loosing their steam? Which have peaked or are reversing themselves? Which are the "wildcards" about to disrupt us in the future? POLITICAL AND TECHNICAL thought for food: Electronics, Materials, Energy, Fossil, Nuclear, Alternative, Other, Manufacturing (techniques), Agriculture, Machinery and Equipment, Distribution, Transportation (Urban, Mass, Personal, Surface, Sea, Subsurface, Space), Communication (Printed, Spoken, Interactive, Media), Computers (Information, Knowledge, Storage & Retrieval, Design, Network Resources), Post-Cold War, Third World, Conflict (Local, Regional, Global), Arms Limitation, Undeclared Wars, Terrorism, Nuclear Proliferation, Weapons of Mass Destruction, Governments (More/Less Power and Larger or Smaller Scale), Taxes, Isms: Nationalism, Regionalism, Protectionism, Populism, Cartels, Multinational Corporations, Balance of Trade, Third Party Payments, Regulations (OSHA, etc.) Environmental Impact, U.S. Prestige Abroad. SOCIAL AND ECONOMIC Food for thought:

Labor Movements, Unemployment / Employment Cycles, Recession, Employment Patterns, Work Hours / Schedules, Fringe Benefits, Management Approaches, Accounting Policies, Productivity, Energy Costs, Balance of Payments, Inflation, Taxes, Rates of Real Growth, Distribution of Wealth, Capital Availability and Costs, Reliability of Forecasts, Raw Materials, Availability and Costs, Global versus National Economy, Market versus Planned Economies, Generations: Y, X, Boomers, Elderly, Urban vs. Rural Lifestyles, Affluent vs. Poor, Neighborhoods and Communities, Planned or Organic Growth.

Got Knowledge?

|

|

| |

|

|

|

|

The Journal of 2020 Foresight

|

|

| |

|

Monday, July 31, 2006

Finding and Investing in Your Own Greendale

Chapter Four: The Tribal Territories

By Steve Howard, CKO

The Knowledge Labs

Table of Contents

Chapter One: Basecamp

Chapter Two: The Ridge

Chapter Three: The Outpost

Chapter Four: The Tribal Territories

“When I was writing these songs and recording them, we had no idea what was going on. Grandpa was my favorite and when he died, I mean he had a, whatever happened, a heart attack or something … that really blew my mind.”

Neil Young & Crazy Horse “Greendale”

DOUBLE NICKEL RANCH: No one wants to find themselves in their mid-50s in a “Trapped and Permanently Temporary” predicament. Especially with so much on the line as Boomers move en mass into what had been the golden retirement years for their parents.

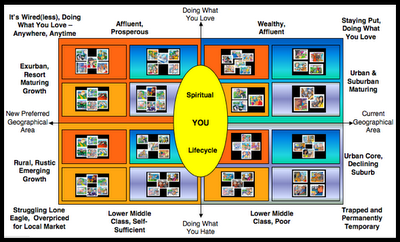

Journal of 2020 Foresight: How do you summarize the four future-proofing scenarios each with their four sub-categories?

Eagle: Well, first of all if it hasn’t dawned on you yet, what started out as just four qualitatively different stories about the future evolved into four sets of four community profiles.

J2020F: So we have 16 options from which to choose.

Eagle: And, one way of evaluating where you want to end up on the grid --between doing what you love or hate and remaining or moving -- is to look for the best fit.

J2020F: Determined by passions, your current life stage and future needs?

Eagle: That’s right. In our model if you aspire to or already live in one of the four communities in the “Staying Put, Doing What You Love” box what attracts you to these locations instead of the other three is a combination of wealth and affluence in more desirable urban and in maturing suburban neighborhoods.

J2020F: Like “The OC”?

Eagle: In less exaggerated ways. Their counterpart for staying in the same geographical area, “Trapped and Permanently Temporary,” plays out in urban cities and declining suburbs, but as you can guess, the neighborhoods attract the lower middle class and the poor.

J2020F: Their common story revolves around the struggle to make ends meet, right?

Eagle: Sure. And, their struggle is similar to “Struggling Lone Eagles, Overpriced for Local Markets.”

J2020F: One difference has to do with obsolescence of marketable skills, while the other has more to do with finding a market?

Eagle: Yes. Eagles remained marketable, but because they live in more rural, rustic and emerging growth communities they enjoy lower cost of living advantages that come with their emphasis on self-sufficiency.

J2020F: So, they can stretch their lower middle class incomes further.

Eagle: Yes. That leaves the affluent and prosperous citizens in the “It’s Wired(less), Doing What You Love – Anywhere, Anytime” story who populate the more well known exurban and maturing growth resorts.

J2020F: You said originally, these stories were intended to be forms of contingency plans – A, B, C and D?

Eagle: Right. If you already enjoy what you do where you live, you want to keep developing yourself to make the most of it. You want to do all you can to prevent falling into the trapped and permanently temporary scenario as you find fewer fulfilling projects to pay for the higher cost of living.

J2020F: If you don’t, what happens?

Eagle: You find yourself forced into an entrepreneurial role that you may not be suited for.

J2020F: And you may be forced to choose between community roots and the following the jobs outsourced offshore or exiting your town, right?

Eagle: If you have found yourself already in the trapped and permanently temporary scenario, when you haven't developed enjoyable and marketable skills, you may have to move to more affordable areas at longer commutes to urban centers.

J2020F: Or, you may find that you need to move to higher quality of life communities with a lower cost of living and take on a new occupation.

Eagle: We also see the model’s value fo taking advantage of real estate markets as they move through up, down and up cycles.

J2020F: Based on Dent’s predictions that Gen Y will drive rental markets and Boomers will drive vacation and retirement markets, even in a down turn?

Eagle: Yes, we’re always looking after the Boomer extended family, and as everyone knows real estate appreciation has already been a big factor in wealth generation for them.

J2020F: So, you believe you can use the model to find better deals – the no-money-down, buy at 30%-to-50%-below-market programs?

Eagle: Yes. When we consider moving to or investing in any of the 16 types of communities, we evaluate six types of real estate opportunities like those -- when to buy, how long to hold, and when to sell – based upon Craig Hall’s book, “Timing the Real Estate Market.”

J2020F: Six types?

Eagle: The primary group we focus on is single family, rental & second family homes. But, since we’re tracking the seven market cycle indicators anyway, we’re monitoring duplexes to apartment buildings; raw land; office property; hospitality – hotels & motels, as well.

J2020F: Seven market cycle indicators?

Eagle: The first is inflation – moderate (1% - 10%), hyper (above 10%) or deflation (less than 0%).

J2020F: Deflation is what Dent predicts for the beginning of the next decade.

Eagle: That’s right. The other six indicators are: interest rates, flow of funds to real estate investments, job growth, migration, path of progress and rate of new construction.

J2020F: It seems complicated, having to choose among 16 communities and to track real estate market timing indicators. Where do you begin?

Eagle: We do the hard work. You just have to start. Remember it all begins with you.

J2020F: And, then you can transplant your business or create a knowledge company?

Got Knowledge?

Copyright ©2002 - 2006 Aarnaes Howard Associates. All rights reserved worldwide.

11:12 AM

|

|

| |

|

|

|